Simple Interest will not add period interest to the principal, whereas Compounding Interest will add the daily interest charge to the principal on a daily and period basis. Select the month and day, and enter the 4-digit year of the date this loan will start accruing interest charges. A Data Record is a set of calculator entries that are stored in your web browser’s Local Storage.

Using this compound interest calculator

Albert Einstein famously referred to compound interest as “the eighth wonder of the world.” Anyone who understands compound interest, earns it. Many bad habits also increase stress while deteriorating health, adding additional costs not reflected in the above table. Many seemingly simple pleasures in life have dramatic longterm costs.

Unveiling the Power of Daily Compound Interest: Your Guide to Exponential Wealth Growth

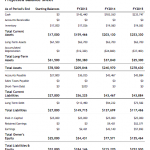

The above example has already shown the difference between simple versus compound interest. To make it more pronounced, let us examine a hypothetical investment with a 15% annual rate of return over ten years. Assuming the https://www.quick-bookkeeping.net/how-to-get-started-with-invoicing-for-your/ returns can be reinvested at the same rate at the end of each year, note how the difference increases as the number of compounding periods goes up. In reality, investment returns will vary year to year and even day to day.

Compounding Interval Comparison

When you put money into an account that earns compound interest, you aren’t just earning interest on your initial deposit amount (known as the principal). Your interest also earns interest, therefore growing your account balance. Compound interest is a powerful and simple way to increase the value of your savings, but you’ll need the right savings account, money market account or investment tool, like a certificate of deposit. In a savings account, compound interest is on your side, helping to accelerate the growth of your dollars. But if you have high-interest credit card debt, compound interest is working against you. The following chart demonstrates the difference that the number of compounding periods can make for a $10,000 investment with an annual 7% interest rate over a 10-year period.

At some point in time, my borrower may send me a payment of $9,050.00 which is applied to the note and then two months later borrows $2,750.00, increasing the note. Then the next month, the borrower sends me $500.00 for the next three months running to be applied to the note. She previously worked as an editor, a writer and a research analyst in industries ranging from health care to market research. She earned a bachelor’s degree in history from the University of California, Berkeley and a master’s degree in social sciences from the University of Chicago, with a focus on Soviet cultural history. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.

Simply divide the number 72 by the annual rate of return to determine how many years it will take to double. Hence, if a two-year savings account containing $1,000 pays a 6% interest rate compounded daily, it will grow to $1,127.49 at the end of two years. Welcome to the world of financial empowerment with daily compound interest – a key to unlocking exponential wealth growth. Our how to calculate amortization comprehensive guide and cutting-edge calculator are designed to demystify this crucial financial concept, helping you harness its potential for your investment journey. Dive into the mechanics of daily compounding and explore how it can significantly impact your long-term financial goals. In the world of finance, one of the most compelling concepts is that of compounding interest.

If it’s not filled in, please enter the title of the calculator as listed at the top of the page. All calculators have been tested to work with the latest Chrome, Firefox, and Safari web browsers (all are free to download). I gave up trying to support other web browsers because they seem to thumb their noses at widely accepted standards. If the calculator didn’t work at all, please try downloading the latest version of Google Chrome or Firefox.

- More frequent compounding periods means greater compounding interest, but the frequency has diminishing returns.

- Each tool is carefully developed and rigorously tested, and our content is well-sourced, but despite our best effort it is possible they contain errors.

- No, the daily interest rate is derive from the annual interest rate by dividing it by the number of compounding periods in a year (typically 365 for daily compounding).

- When compounding of interest takes place, the effective annual rate becomes higher than the overall interest rate.

She graduated from the University of Texas at Austin with a bachelor’s degree in journalism, and has worked in the newsrooms of KUT and the Austin Chronicle. When not working, she is probably paddle boarding, hopping on a flight or reading for her book club. The effective interest rate (or effective annual rate) is the rate that gets paid after all the compounding.

This process is repeated each month if you don’t pay off your balance in full. Now that we know how credit card interest is calculated, we can talk about how and when credit card issuers apply that interest. In most cases, credit card interest is charged when you don’t pay your full balance by the end of your grace period and decide to carry a balance from month to month.

This compounding effect causes investments to grow fasterover time, much like a snowball gaining size as it rolls downhill. If your initial investment is $5,000 with a 0.5% daily interest rate, your interest after the first day will be $25. If you choose an 80% daily reinvestment rate, $20 will be added to your investment balance,giving you https://www.quick-bookkeeping.net/ a total of $5020 at the end of day one. With some types of investments, you might find that your interest is compounded daily, meaning that you’re earning interest on both the principalamount and previously accrued interest on a daily basis. This is often the case with trading where margin is used (you are borrowing money to trade).