For example, Discover Financial Services has accelerated its credit assessment processes by ten times and achieve a more accurate view of borrowers by using AI technologies in evaluating credit applicants. For more on credit scoring, feel free to read our article on the topic or access an interactive list of leading vendors in the space. AI is particularly helpful in corporate finance as it can better predict and assess loan risks. For companies looking to increase their value, AI technologies such as machine learning can help improve loan underwriting and reduce financial risk. AI can also lessen financial crime through advanced fraud detection and spot anomalous activity as company accountants, analysts, treasurers, and investors work toward long-term growth. Robo-advisors like Wealthfront and Betterment automate the traditional process of working with an advisor to outline investing goals, time horizons, and risk tolerances in order to create a portfolio that meets the needs of the investor.

Access to new AI innovations?

- AI and blockchain are both used across nearly all industries — but they work especially well together.

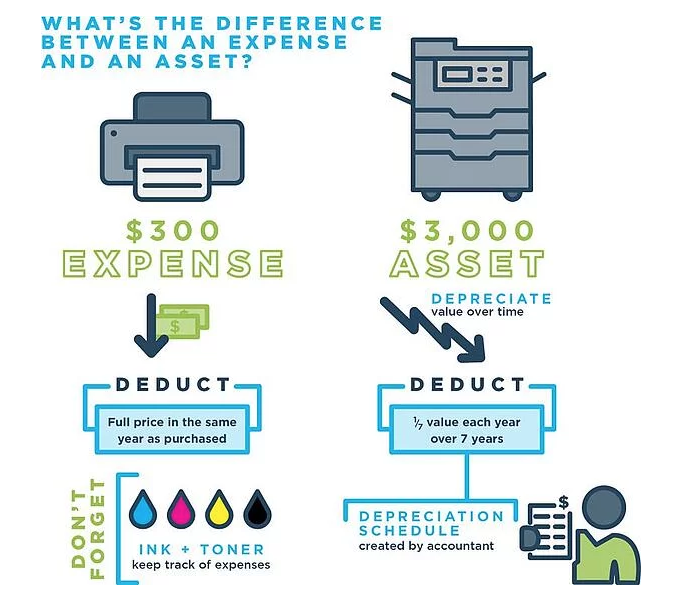

- Expenditure reports require travel receipt checks (like hotel reservations, flight tickets, gas station receipts, etc.) for compliance, VAT deduction regulations, and income tax laws.

- Powered by generative large language models, these chatbots excel at understanding intent and can redirect customers to human representatives when needed.

- AI is having a moment, and the hype around AI innovation over the past year has reached new levels for good reason.

Deploying cutting-edge AI tools like Scale’s Enterprise Copilot helps analysts and wealth managers summarize large amounts of data, making them more effective and accurate advisors. Source content includes financial statements, historical data, news, social media, and research reports. With a Copilot, each Wealth Manager becomes many times more efficient and accurate in their work, multiplying their value to a financial services firm. With Oracle Fusion Cloud ERP, companies have a centralized data repository, giving AI models an accurate, up-to-date, and complete foundation of data.

Enhance risk management

For example, CitiBank has inked a deal with data science market leader Feedzai, which helps to flag suspicious payments and safeguard trillions of dollars in daily operations. Feedzai conducts large-scale https://www.adprun.net/what-is-gross-monthly-income/ analyses to identify fraudulent or dubious activity and alert the customer. The rise of Artificial intelligence (AI) in the global financial services landscape is undergoing a major transformation.

Powerful data and analysis on nearly every digital topic

It helps shift the role of finance from reporting on the past to focusing on the future, through analysis and forecasts that serve the company. Increased automation also means improved accuracy across your financial processes. High volume, mundane processes, such as invoice entry, can lead to fatigue, burnout, and error in humans.

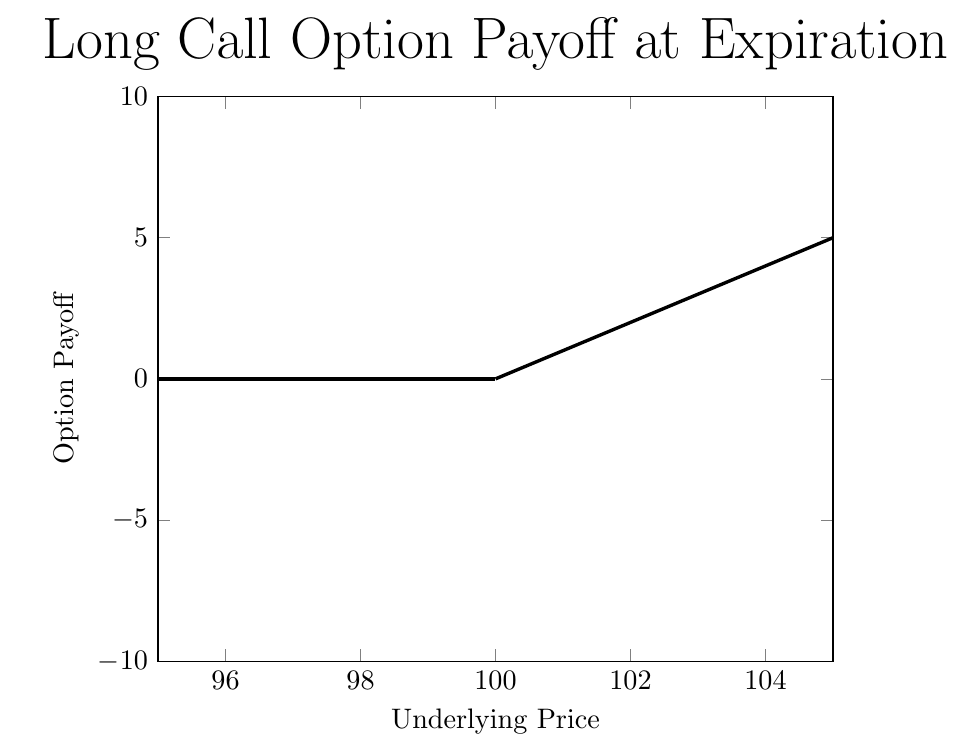

This includes fundamental data, such as a company’s earnings, cash flow, and any other data that may impact the stock’s price. Artificial intelligence is also used in technical analysis tools, which include data related to the number of shares traded, and other mathematical criteria related to past price activity. A valuable research area that should be further explored concerns the incorporation of text-based input data, such as tweets, blogs, and comments, for option price prediction (Jang and Lee 2019). Since derivative pricing is an utterly complicated task, Chen and Wan (2021) suggest studying advanced AI designs that minimise computational costs. Funahashi (2020) recognises a typical human learning process (i.e. recognition by differences) and applies it to the model, significantly simplifying the pricing problem. In the light of these considerations, prospective research may also investigate other human learning and reasoning paths that can improve AI reasoning skills.

The operating model with the best results

Thus, employing AI-powered chatbots and virtual assistants can help to handle massive volumes in real-time. The virtual assistants have underlying use of natural language processing (NLP) capabilities, which can deal with complex financial questions. Zeni uses AI to automate accounting, spending, and budgeting processes to streamline financial operations. It provides real-time financial data analysis to improve business decisions, integrating AI with human knowledge for the most effective information. Many financial institutions are incorporating AI into their portfolio valuation processes to address these challenges. Financial institutions can enhance accuracy, efficiency, and decision-making with ai-powered asset valuation that is automated and accurate.

In the short term, generative AI will allow for further automation of financial analysis and reporting, enhancement of risk mitigation efforts, and optimization of financial operations. With its ability to process vast amounts of data and quickly produce novel content, generative AI holds a promise for progressive disruptions we cannot yet anticipate. Our surveys also show that about 20 percent of the financial institutions studied use the highly centralized operating-model archetype, centralizing gen AI strategic steering, standard setting, and execution. About 30 percent use the centrally led, business unit–executed approach, centralizing decision making but delegating execution. Roughly 30 percent use the business unit–led, centrally supported approach, centralizing only standard setting and allowing each unit to set and execute its strategic priorities.

Guardrails to ensure ethics, regulatory compliance, transparency and explainability—so that stakeholders understand the decisions made by the financial institution—are essential in order to balance the benefits of AI with responsible and accountable use. By establishing oversight and clear rules regarding its application, AI can continue to evolve as a trusted, powerful tool in the financial industry. TQ Tezos leverages blockchain technology to create new tools on Tezos blockchain, working with global partners to launch organizations and software designed for public use.

Investors should, therefore, look at the various investing tools that use AI on their existing platform to ensure that they are sufficient for their needs. If not, investors may want to consider either a different broker with more robust AI investing tools, or supplementing their broker platform with third-party AI investing software; an example would be using a separate stock screener for choosing stocks. All of the companies that trade on U.S. stock markets have many data points that investors can use to determine what stocks they want to buy or sell. Artificial intelligence allows investors to efficiently sort through this data to identify stocks that meet their criteria. If you’re looking to get started with a stock screener, consider learning how to use these platforms by starting with one of the many free versions that are available, like ZACKS (NASDAQ). The volatility index (VIX) from Chicago Board Options Exchange (CBOE) is a measure of market sentiment and expectations.

This means the copilots are even more powerful, providing a productivity boost for wealth managers while increasing customer satisfaction as investors get personalized advice more quickly. Investment companies have started to use AI to detect the patterns in the market and predict their future values. By that, AI can discover a broader range of trading opportunities where humans can’t detect. Another benefit of AI is that it can analyze large amounts of complex data faster than people, which provides time and money-saving.

QuantumBlack Labs is our center of technology development and client innovation, which has been driving cutting-edge advancements and developments in AI through locations across the globe. While many investment firms rely on fully or partially automated investment strategies, the best results are still achieved by keeping humans in the loop and combining AI insights with human analysts’ https://www.accountingcoaching.online/ reasoning capabilities. Cem’s hands-on enterprise software experience contributes to the insights that he generates. He oversees AIMultiple benchmarks in dynamic application security testing (DAST), data loss prevention (DLP), email marketing and web data collection. Other AIMultiple industry analysts and tech team support Cem in designing, running and evaluating benchmarks.

Deep networks, in particular, efficiently predict the direction of change in forex rates thanks to their ability to “learn” abstract features (i.e. moving averages) through hidden layers. Future work should study whether these abstract features can be inferred from the model and used as valid input data to simplify the deep network structure (Galeshchuk and Mukherjee 2017). Moreover, the performance of foreign exchange trading models should be assessed in financial distressed times.

While traditional banking institutions are interested in incorporating new technologies, fintechs are adopting this technology more quickly as they try to catch up with larger institutions. To stay ahead of the game, larger financial institutions are investing heavily, with 77% what is accrued payroll definition and example planning to increase their budgets over the next three years, according to Scale’s 2023 AI Readiness report. Companies can introduce AI-based invoice capture technologies to automate their invoice systems and use accessible billing services that remind their customers to pay.

This guide covered the most prominent use cases and applications for AI in finance. We covered investment research, fraud detection and anti-money laundering, customer-facing process automation, personalized assistants/chatbots, personalized portfolio analysis, exposure modeling, portfolio valuation, and risk modeling. Automation using AI is essential for the financial services industry to meet customer demands for better personalization and enhanced features while reducing costs.